Member Tools

These tools and more are available in Web Member Services, the PSRS/PEERS online, self-service membership information portal. Click the links below if you already have a Web Member Services account or register to activate your account.

Tools for Active Members

- View Member Statements

- Estimate Service Retirement Benefits

- Calculate a Purchase Cost

- File for Service Retirement Online

- Designate or Update Beneficiaries

Tools for Retirees and Beneficiaries

Retirement Education

We want to help you learn more about your benefits and retirement system. Our counselors are here to help you get all the information you need, and offer a variety of educational opportunities to best fit your busy life.

Meet the Team » View PSRS Education Options » View PEERS Education Options »PSRS/PEERS News

October 2021 Board of Trustees Meeting Summary

The Public School and Education Employee Retirement Systems of Missouri (PSRS/PEERS) Board of Trustees convened on October 25, 2021, at 9 a.m. In attendance were Board members Jason Steliga, Beth Knes, Dr. Kyle Collins, Sharon Kissinger, Dr. Eric Park and Dr. Melinda Moss. Also present were Executive Director Dearld Snider; Assistant Executive Director, Operations Bill Betts; Assistant Executive Director, Investments Craig Husting; General Counsel Sarah Swoboda; Chief Financial Officer Anita Brand; Director of Member Services Nicole Hamler; Director of Employer Services Stacie Verslues; Director of Legislation and Policy Maria Walden; Director of Communications Susan Wood; Chief Technology Officer Lisa Scheulen; Human Resources/Benefit Plan Administrator Kim Harris; Director of Executive and Board Administration Jennifer Martin; and various other PSRS/PEERS staff members.

Regular Board Meeting

System Operations

Approval of Minutes

The open session minutes from the August 29, 2021 and August 30, 2021 meetings and the September 29, 2021 special meeting were approved by unanimous vote.

Order of Business

Executive Director Dearld Snider, presented plaques to Jean Fick and Penny Kugler for their dedication, service and retirement from PSRS/PEERS.

Other

None

Investment Report

Ongoing Investment Activity

Mr. Craig Husting from PSRS/PEERS and Ms. Margaret Jadallah from Verus reviewed ongoing investment activities, which included estimated investment performance through September 30, 2021. The estimated return for the first quarter of fiscal year 2022 (July 1, 2021, through September 30, 2021) was approximately 1.3%. Mr. Husting discussed the current asset allocation of the PSRS/PEERS portfolio, in which he reviewed the long-term strategy, portfolio themes and the broad portfolio expectations.

Proxy Voting Policy

Mr. Husting reviewed the Systems' Proxy Voting Policy. The Systems' active public equity investment managers are each responsible for voting proxies in the best interests of the members of the Systems. The managers are required to provide an annual report to the investment staff detailing how their proxies were voted during the year on behalf of PSRS/PEERS. Mr. Husting reported that the Systems received proxy voting reports from all public equity managers for fiscal year 2021. The internal PSRS/PEERS staff has not identified any operational issues with the proxy voting process during the review that was conducted this year and all investment managers are in compliance with the policy.

Real Estate Annual Review

Mr. Seth Marcus and Ms. Kathryn Finneran from Townsend (the Systems' real estate consultant), presented several items to the Board, including a real estate market overview and details of the PSRS/PEERS real estate portfolio. Townsend reported that the PSRS/PEERS' real estate portfolio had produced an annualized return of 8.0% (net of all fees) for the five-year period ended June 30, 2021.

Report of Actuary

June 30, 2021 Actuarial Valuations

Mr. Brandon Robertson, Ms. Cindy Fraterrigo and Ms. Becky Brenza from PricewaterhouseCoopers (PwC), the Systems' actuary, were present to discuss the results of the June 30, 2021 actuarial valuations for the Systems.

Ms. Fraterrigo provided an overview of the purpose of the annual actuarial valuations and the key components. Mr. Robertson reviewed recent key developments and discussed the experience study that was conducted earlier this year. Ms. Brenza reviewed the June 30, 2021, actuarial valuation information prepared by PwC. Ms. Brenza reviewed the changes in membership, assets, liabilities, and the pre-funded status of each System. She reported that the June 30, 2021 preliminary pre-funded status based on the actuarial value of assets of PSRS was 85.2% and PEERS was 87.7%. The funded status of both Systems is viewed to be healthy and a result of appropriately set actuarial assumptions, consistent funding of the required contributions and diligent plan governance. Mr. Robertson discussed projections of contribution rates, funded status and the sensitivities of both to the overall investment returns and cost-of-living adjustments for the plans.

Review COLA Scenarios

Ms. Anita Brand from PSRS/PEERS reviewed the financial impacts of changes to the current COLA policy and current assumed rate of return. For each scenario, the impact on future contribution rates and the funded status of the Systems was analyzed. Based on the results of each scenario, staff and PwC recommended no changes.

Set Contribution Rates for Fiscal Year 2022-2023

The Board voted unanimously to maintain the contribution rate for PSRS at 29% and PEERS at 13.72% for fiscal year 2022-2023, as recommended by the actuary.

Set January 2022 Cost-of-Living-Adjustment (COLA)

In accordance with the Systems' Funding Policy and the recommendation of the actuary, the Board voted unanimously to grant a 5% COLA for January 2022.

Management Report

Facility Renovation

Mr. Bill Betts of PSRS/PEERS provided a high-level recap of the construction timeline for the new building addition and renovation. Construction of the new addition, along with the renovation, are both almost complete with a few minor projects being finalized. Final finishes are due to be complete by December 31, 2021.

Revised Mission Statement

The Board approved the new mission statement for the Systems to be, "To provide financial security and peace of mind for Missouri's public education community."

2022 Election Schedule Approval

The Board approved the following 2022 trustee election schedule:

| Activity | Deadline |

| Notices and information to organizations for their publication deadlines | November 15, 2021 (Monday) |

| Official notice to all employing units | November 29, 2021 (Monday) |

| Petition forms available | January 10, 2022 (Monday) |

| Bids on election process | January 2022 |

| Nominating petitions - postmark deadline | February 24, 2022 (Thursday) |

| Petition signature audit and certification | March 11, 2022 (Friday) |

| Ballots mailed to members | April 5, 2022 (Tuesday) |

| Electronic voting deadline and ballots due - postmark deadline | April 20, 2022 (Wednesday) |

| Official count and certification | May 3, 2022 (Tuesday) |

CPI-U Update

Mr. Dearld Snider from PSRS/PEERS reviewed the COLA policy that was set by the Board of Trustees at their November 3, 2017, meeting. According to the policy, COLAs may be granted based on the CPI-U as follows:

| CPI-U | COLA per Board-Approved Funding Policy |

|---|---|

| Less than 0.0% | 0.0% |

| 0.0%-2.0% | 0.0% when CPI-U is cumulatively below 2.0% |

| 0.0%-2.0% | 2.0% when CPI-U cumulatively reaches 2.0% or more* |

| 2.0%-5.0% | 2.0% when the CPI-U is at least 2.0%, but less than 5.0% |

| 5.0% or more | 5.0% |

| *resets cumulative calculation after a COLA is provided | |

Mr. Snider explained that the Consumer Price Index for Urban Consumers (CPI-U) is calculated by the Bureau of Labor Statistics (BLS). The CPI-U is the measure of the change in prices of goods and services purchased by urban consumers between any two time periods. PSRS/PEERS' regulation requires that the time period for the CPI-U calculation used in the determination of a COLA be from June to June. Based on the values provided by the BLS, the CPI-U is up 0.9621% through September 30, 2021.

| Index Values | |||

|---|---|---|---|

| June 2021 | 271.696 | Month | To-Date |

| July 2021 | 273.003 | 0.0082 | 0.4811% |

| August 2021 | 273.567 | 0.0021 | 0.6886% |

| September 2021 | 274.310 | 0.0027 | 0.9621% |

The October reading for the CPI-U will not be released until November 12, 2021.

Public Comment

None

Other

Mr. Snider gave a brief update on the security incident that occurred at PSRS/PEERS on September 11, 2021. As of Monday morning, October 25, 2021, over 14,000 members have registered with Experian for the free 24-month credit monitoring service offered by PSRS/PEERS. Experian took over 5,000 phone calls last week.

Trustee Dr. Eric Park gave kudos to the PSRS/PEERS staff for their ability to perform so efficiently and effectively under stress during the security incident.

Closed Session

The Board went into closed session at 12 p.m.

Adjournment

The Board adjourned at 5:30 p.m.

Tuesday, October 26, 2021

Closed Session

The Board rejoined closed session at 8 a.m.

Adjournment

The Board adjourned at 9 a.m.

This summary is not official minutes of the PSRS/PEERS Board of Trustees meeting. The official minutes will be approved at the next PSRS/PEERS Board of Trustees meeting and will posted to our website at that time.

October 2021 Board of Trustees Meeting Summary

The Public School and Education Employee Retirement Systems of Missouri (PSRS/PEERS) Board of Trustees convened on October 25, 2021, at 9 a.m. In attendance were Board members Jason Steliga, Beth Knes, Dr. Kyle Collins, Sharon Kissinger, Dr. Eric Park and Dr. Melinda Moss. Also present were Executive Director Dearld Snider; Assistant Executive Director, Operations Bill Betts; Assistant Executive Director, Investments Craig Husting; General Counsel Sarah Swoboda; Chief Financial Officer Anita Brand; Director of Member Services Nicole Hamler; Director of Employer Services Stacie Verslues; Director of Legislation and Policy Maria Walden; Director of Communications Susan Wood; Chief Technology Officer Lisa Scheulen; Human Resources/Benefit Plan Administrator Kim Harris; Director of Executive and Board Administration Jennifer Martin; and various other PSRS/PEERS staff members.

Regular Board Meeting

System Operations

Approval of Minutes

The open session minutes from the August 29, 2021 and August 30, 2021 meetings and the September 29, 2021 special meeting were approved by unanimous vote.

Order of Business

Executive Director Dearld Snider, presented plaques to Jean Fick and Penny Kugler for their dedication, service and retirement from PSRS/PEERS.

Other

None

Investment Report

Ongoing Investment Activity

Mr. Craig Husting from PSRS/PEERS and Ms. Margaret Jadallah from Verus reviewed ongoing investment activities, which included estimated investment performance through September 30, 2021. The estimated return for the first quarter of fiscal year 2022 (July 1, 2021, through September 30, 2021) was approximately 1.3%. Mr. Husting discussed the current asset allocation of the PSRS/PEERS portfolio, in which he reviewed the long-term strategy, portfolio themes and the broad portfolio expectations.

Proxy Voting Policy

Mr. Husting reviewed the Systems' Proxy Voting Policy. The Systems' active public equity investment managers are each responsible for voting proxies in the best interests of the members of the Systems. The managers are required to provide an annual report to the investment staff detailing how their proxies were voted during the year on behalf of PSRS/PEERS. Mr. Husting reported that the Systems received proxy voting reports from all public equity managers for fiscal year 2021. The internal PSRS/PEERS staff has not identified any operational issues with the proxy voting process during the review that was conducted this year and all investment managers are in compliance with the policy.

Real Estate Annual Review

Mr. Seth Marcus and Ms. Kathryn Finneran from Townsend (the Systems' real estate consultant), presented several items to the Board, including a real estate market overview and details of the PSRS/PEERS real estate portfolio. Townsend reported that the PSRS/PEERS' real estate portfolio had produced an annualized return of 8.0% (net of all fees) for the five-year period ended June 30, 2021.

Report of Actuary

June 30, 2021 Actuarial Valuations

Mr. Brandon Robertson, Ms. Cindy Fraterrigo and Ms. Becky Brenza from PricewaterhouseCoopers (PwC), the Systems' actuary, were present to discuss the results of the June 30, 2021 actuarial valuations for the Systems.

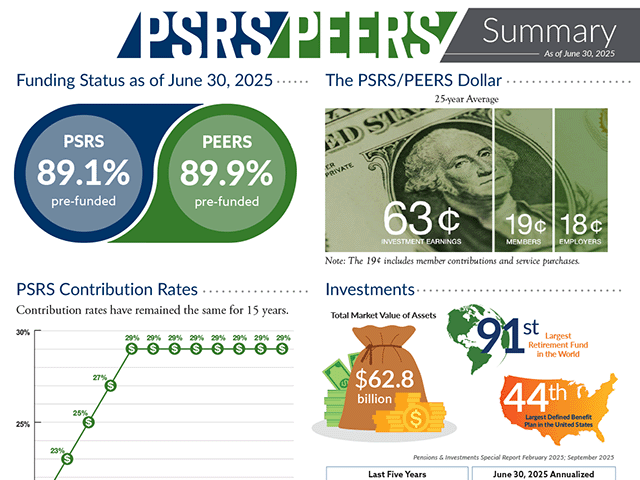

Ms. Fraterrigo provided an overview of the purpose of the annual actuarial valuations and the key components. Mr. Robertson reviewed recent key developments and discussed the experience study that was conducted earlier this year. Ms. Brenza reviewed the June 30, 2021, actuarial valuation information prepared by PwC. Ms. Brenza reviewed the changes in membership, assets, liabilities, and the pre-funded status of each System. She reported that the June 30, 2021 preliminary pre-funded status based on the actuarial value of assets of PSRS was 85.2% and PEERS was 87.7%. The funded status of both Systems is viewed to be healthy and a result of appropriately set actuarial assumptions, consistent funding of the required contributions and diligent plan governance. Mr. Robertson discussed projections of contribution rates, funded status and the sensitivities of both to the overall investment returns and cost-of-living adjustments for the plans.

Review COLA Scenarios

Ms. Anita Brand from PSRS/PEERS reviewed the financial impacts of changes to the current COLA policy and current assumed rate of return. For each scenario, the impact on future contribution rates and the funded status of the Systems was analyzed. Based on the results of each scenario, staff and PwC recommended no changes.

Set Contribution Rates for Fiscal Year 2022-2023

The Board voted unanimously to maintain the contribution rate for PSRS at 29% and PEERS at 13.72% for fiscal year 2022-2023, as recommended by the actuary.

Set January 2022 Cost-of-Living-Adjustment (COLA)

In accordance with the Systems' Funding Policy and the recommendation of the actuary, the Board voted unanimously to grant a 5% COLA for January 2022.

Management Report

Facility Renovation

Mr. Bill Betts of PSRS/PEERS provided a high-level recap of the construction timeline for the new building addition and renovation. Construction of the new addition, along with the renovation, are both almost complete with a few minor projects being finalized. Final finishes are due to be complete by December 31, 2021.

Revised Mission Statement

The Board approved the new mission statement for the Systems to be, "To provide financial security and peace of mind for Missouri's public education community."

2022 Election Schedule Approval

The Board approved the following 2022 trustee election schedule:

| Activity | Deadline |

| Notices and information to organizations for their publication deadlines | November 15, 2021 (Monday) |

| Official notice to all employing units | November 29, 2021 (Monday) |

| Petition forms available | January 10, 2022 (Monday) |

| Bids on election process | January 2022 |

| Nominating petitions - postmark deadline | February 24, 2022 (Thursday) |

| Petition signature audit and certification | March 11, 2022 (Friday) |

| Ballots mailed to members | April 5, 2022 (Tuesday) |

| Electronic voting deadline and ballots due - postmark deadline | April 20, 2022 (Wednesday) |

| Official count and certification | May 3, 2022 (Tuesday) |

CPI-U Update

Mr. Dearld Snider from PSRS/PEERS reviewed the COLA policy that was set by the Board of Trustees at their November 3, 2017, meeting. According to the policy, COLAs may be granted based on the CPI-U as follows:

| CPI-U | COLA per Board-Approved Funding Policy |

|---|---|

| Less than 0.0% | 0.0% |

| 0.0%-2.0% | 0.0% when CPI-U is cumulatively below 2.0% |

| 0.0%-2.0% | 2.0% when CPI-U cumulatively reaches 2.0% or more* |

| 2.0%-5.0% | 2.0% when the CPI-U is at least 2.0%, but less than 5.0% |

| 5.0% or more | 5.0% |

| *resets cumulative calculation after a COLA is provided | |

Mr. Snider explained that the Consumer Price Index for Urban Consumers (CPI-U) is calculated by the Bureau of Labor Statistics (BLS). The CPI-U is the measure of the change in prices of goods and services purchased by urban consumers between any two time periods. PSRS/PEERS' regulation requires that the time period for the CPI-U calculation used in the determination of a COLA be from June to June. Based on the values provided by the BLS, the CPI-U is up 0.9621% through September 30, 2021.

| Index Values | |||

|---|---|---|---|

| June 2021 | 271.696 | Month | To-Date |

| July 2021 | 273.003 | 0.0082 | 0.4811% |

| August 2021 | 273.567 | 0.0021 | 0.6886% |

| September 2021 | 274.310 | 0.0027 | 0.9621% |

The October reading for the CPI-U will not be released until November 12, 2021.

Public Comment

None

Other

Mr. Snider gave a brief update on the security incident that occurred at PSRS/PEERS on September 11, 2021. As of Monday morning, October 25, 2021, over 14,000 members have registered with Experian for the free 24-month credit monitoring service offered by PSRS/PEERS. Experian took over 5,000 phone calls last week.

Trustee Dr. Eric Park gave kudos to the PSRS/PEERS staff for their ability to perform so efficiently and effectively under stress during the security incident.

Closed Session

The Board went into closed session at 12 p.m.

Adjournment

The Board adjourned at 5:30 p.m.

Tuesday, October 26, 2021

Closed Session

The Board rejoined closed session at 8 a.m.

Adjournment

The Board adjourned at 9 a.m.

This summary is not official minutes of the PSRS/PEERS Board of Trustees meeting. The official minutes will be approved at the next PSRS/PEERS Board of Trustees meeting and will posted to our website at that time.

Tune in to stay informed about your retirement system, gain valuable insights, and hear from experts on how to make the most of your benefits. Join us for engaging discussions and essential updates designed with your needs in mind.

Life Events

When life brings changes your way, it can also impact your PSRS/PEERS membership. Click below for more information.

Welcome! Your membership gives you distinct advantages when working toward a financially secure retirement. Get off to the right start and register for access to Web Member Services today.

If you are recently married, it can impact your beneficiary designations.

Birth or adoption of a child requires you to update your beneficiary designations.

If you named your spouse as a beneficiary, divorce means you may need to update your beneficiary designations. Some divorced retirees may also have options for benefit increases, or "pop-ups."

Keep your contact information up-to-date so we can communicate with you about your membership and ensure benefits are paid according to your wishes.

Apply for service retirement online using Web Member Services, or using paper forms found on this website.

You have options when temporarily or permanently leaving covered employment.

It is important to understand post-retirement work limits and how they may impact your benefit payments.

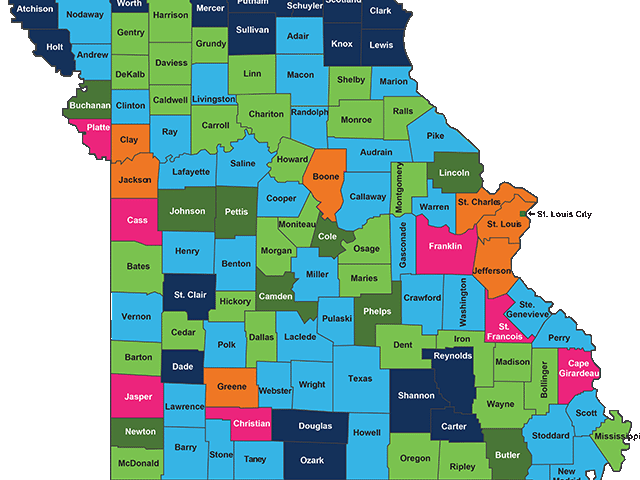

As of June 30, 2025, approximately 113,000 individuals received benefits from PSRS/PEERS. Total annual benefits paid was nearly $4.0 billion. Of this amount, over $3.5 billion, or 88%, was distributed among Missouri's 114 counties, positively impacting the state's economy.

A summary of PSRS/PEERS statistics as of June 30, 2025.

PSRS/PEERS' funding comes from three sources, member contributions, employer contributions and investment earnings. Investment earnings are the primary source of funding for every dollar of PSRS/PEERS benefits paid.