The primary goal of the PSRS/PEERS investments program is to ensure that the Retirement Systems are financially stable, and that all members receive the financial security they have earned through their hard work and dedication to Missouri's educational system.

The PSRS/PEERS investment portfolio is made up of member and employer contributions to the plans and investment earnings on those assets. Investment earnings are used to pay current and future benefits to members and their families.

Our Approach to Investments:

- We are a long-term investor.

- We manage your assets with closely monitored levels of risk, in a diversified portfolio structured to withstand short-term shocks to the markets, yet positioned to provide consistent asset growth over time.

- Our long-term goal is to achieve a total investment return of at least 7.3% per year.

Investments Intern Program

Discover the world of investment management as a summer intern at PSRS/PEERS! Experience hands-on collaboration alongside our esteemed investment team, ensuring valuable insights across diverse asset classes from public equity to private credit, real estate and more.

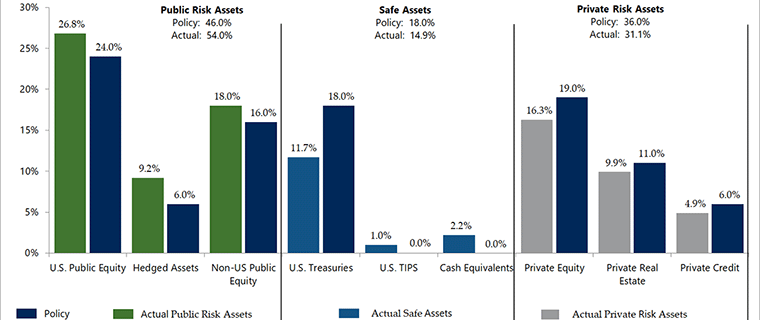

The time horizon of the Systems' investment portfolio reflects the long-term nature of the PSRS/PEERS pension obligations. Accordingly, diversification among investments displaying unique risk and return characteristics provides the framework for selecting an asset allocation that is expected, in the aggregate, to give the funds the highest long-term return within a prudent risk level.

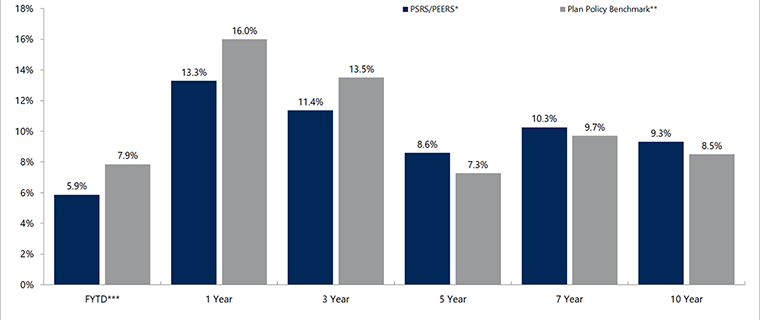

The Systems’ earned an investment return of 13.3% for the one year period ended December 31, 2025. The total plan return underperformed the policy benchmark return but exceeded the Systems’ long-term investment objective.

The total assets for the combined Systems stood at $65.3 billion as of December 31, 2025, compared to $62.8 billion at the beginning of the 2026 Fiscal Year (July 1, 2025).