Proper Termination of Employment Before Retirement

Even if you meet all the eligibility requirements for service retirement, you are not eligible to receive benefits unless you have properly terminated your pre-retirement employment.

Be careful when planning post-retirement work. Returning to post-retirement employment, agreeing to post-retirement employment, or taking a retirement incentive that includes post-retirement work in exchange for salary (including health insurance benefits) may mean you have not properly terminated your employment.

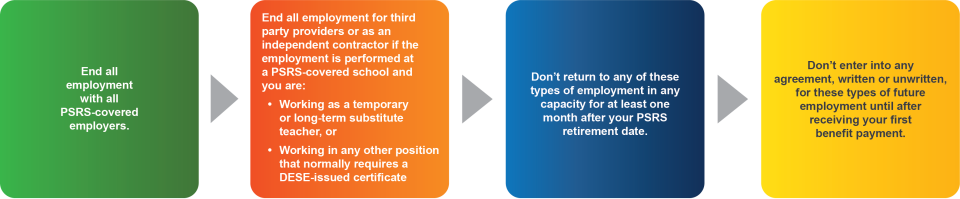

To properly terminate your employment:

Failure to properly terminate employment can be costly! You are required to repay benefits you receive while not eligible and pay PSRS contributions until you properly terminate your employment. The minimum amount is one full monthly benefit.

If you have questions about terminating your employment, contact us.