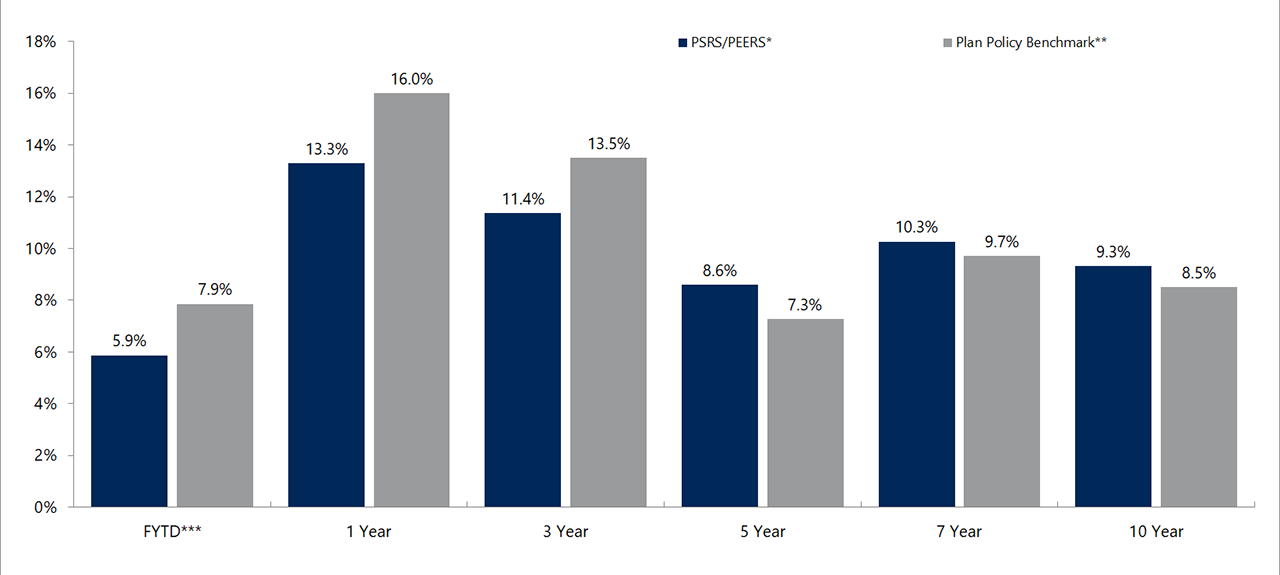

Total Fund Investment Returns

As of December 31, 2025

The Board has established a long-term objective to achieve a total investment return of at least 7.3% per year and a real rate of return of at least 5.3% per year. The real rate of return is the rate by which the long-term total return exceeds the inflation rate.

The Systems’ earned an investment return of 13.3% for the one year period ended December 31, 2025. The total plan return underperformed the policy benchmark return but exceeded the Systems’ long-term investment objective.

The Systems have produced significant absolute returns over all reported time periods and strong relative returns for the 5-, 7-, and 10-year time periods. Additionally, over long periods of time, PSRS and PEERS continue to produce investment returns that meet or exceed the Systems' objective. The annualized investment return over the last 30 years is 7.9%.

* Effective July 1, 2013 all assets are held in the Missouri Education Pension Trust (MEPT) for the exclusive benefit of the Public School and Education Employee Retirement Systems of Missouri.

** The Policy Benchmark is comprised of 39.75% Russell 3000 Index, 22.25% MSCI ACWI ex-USA Index, 18% Bloomberg Barclays U.S. Treasury, 11% NCREIF Open End Diversified Core Equity Index, 6% Bloomberg Barclays U.S. Intermediate Credit Index, and 3% ICE BofA U.S. High Yield Master II Index.

*** The Retirement Systems’ 2026 Fiscal Year began on July 1, 2025.