Member Tools

These tools and more are available in Web Member Services, the PSRS/PEERS online, self-service membership information portal. Click the links below if you already have a Web Member Services account or register to activate your account.

Tools for Active Members

- View Member Statements

- Estimate Service Retirement Benefits

- Calculate a Purchase Cost

- File for Service Retirement Online

- Designate or Update Beneficiaries

Tools for Retirees and Beneficiaries

Retirement Education

We want to help you learn more about your benefits and retirement system. Our counselors are here to help you get all the information you need, and offer a variety of educational opportunities to best fit your busy life.

View PSRS Education Options » View PEERS Education Options »PSRS/PEERS News

Board of Trustees Unanimously Votes to Maintain Contribution Rates

Contribution rates for PSRS and PEERS members and employers will not change for the 2016-2017 school year.

| Employee Rate | Employer Rate | Combined Rate |

|---|---|---|

| 14.5% | 14.5% | 29% |

| Employee Rate | Employer Rate | Combined Rate |

|---|---|---|

| 6.86% | 6.86% | 13.72% |

At the October 26, 2015 Public School and Education Employee Retirement Systems of Missouri (PSRS/PEERS) Board of Trustees' meeting, the Board voted unanimously to maintain the current contribution rates for the 2016-2017 school year. This action was based on the recommendation of the Systems' actuary, PricewaterhouseCoopers (PwC).

According to PwC, PSRS is 83.9% prefunded and PEERS is 86.8% prefunded. Both are considered to be financially healthy. PwC indicated that there could be an impact on the future pre-funded status and contribution rates dependent on investment and actuarial assumptions, which are currently being reviewed.

PSRS/PEERS is primarily funded by investment earnings, but also through the contributions made by you and your employers. PSRS/PEERS contributions are automatically deducted from your pay and are credited to your individual membership. You do not pay taxes on your contributions until you receive them back from PSRS/PEERS as monthly benefits or a lump-sum payment.

For more information on your PSRS/PEERS contributions and how they help fund benefits, refer to your Member Handbook found on the publications page of this website.

For specific information regarding the contributions you have made to PSRS/PEERS during your membership, refer to your annual Member Statement, which will be mailed to you in November. Your statement will also be available in November via PSRS/PEERS Web Member Services.Board of Trustees Unanimously Votes to Maintain Contribution Rates

Contribution rates for PSRS and PEERS members and employers will not change for the 2016-2017 school year.

| Employee Rate | Employer Rate | Combined Rate |

|---|---|---|

| 14.5% | 14.5% | 29% |

| Employee Rate | Employer Rate | Combined Rate |

|---|---|---|

| 6.86% | 6.86% | 13.72% |

At the October 26, 2015 Public School and Education Employee Retirement Systems of Missouri (PSRS/PEERS) Board of Trustees' meeting, the Board voted unanimously to maintain the current contribution rates for the 2016-2017 school year. This action was based on the recommendation of the Systems' actuary, PricewaterhouseCoopers (PwC).

According to PwC, PSRS is 83.9% prefunded and PEERS is 86.8% prefunded. Both are considered to be financially healthy. PwC indicated that there could be an impact on the future pre-funded status and contribution rates dependent on investment and actuarial assumptions, which are currently being reviewed.

PSRS/PEERS is primarily funded by investment earnings, but also through the contributions made by you and your employers. PSRS/PEERS contributions are automatically deducted from your pay and are credited to your individual membership. You do not pay taxes on your contributions until you receive them back from PSRS/PEERS as monthly benefits or a lump-sum payment.

For more information on your PSRS/PEERS contributions and how they help fund benefits, refer to your Member Handbook found on the publications page of this website.

For specific information regarding the contributions you have made to PSRS/PEERS during your membership, refer to your annual Member Statement, which will be mailed to you in November. Your statement will also be available in November via PSRS/PEERS Web Member Services.Life Events

When life brings changes your way, it can also impact your PSRS/PEERS membership. Click below for more information.

A New Member

Welcome! Your membership gives you distinct advantages when working toward a financially secure retirement. Get off to the right start and register for access to Web Member Services today.

Newly Married

If you are recently married, it can impact your beneficiary designations.

A New Parent

Birth or adoption of a child requires you to update your beneficiary designations.

Recently Divorced

If you named your spouse as a beneficiary, divorce means you may need to update your beneficiary designations. Some divorced retirees may also have options for benefit increases, or "pop-ups."

Moving

Keep your contact information up-to-date so we can communicate with you about your membership and ensure benefits are paid according to your wishes.

Ready to Retire

Apply for service retirement online using Web Member Services, or using paper forms found on this website.

Leaving Your Job

You have options when temporarily or permanently leaving covered employment.

A Working Retiree

It is important to understand post-retirement work limits and how they may impact your benefit payments.

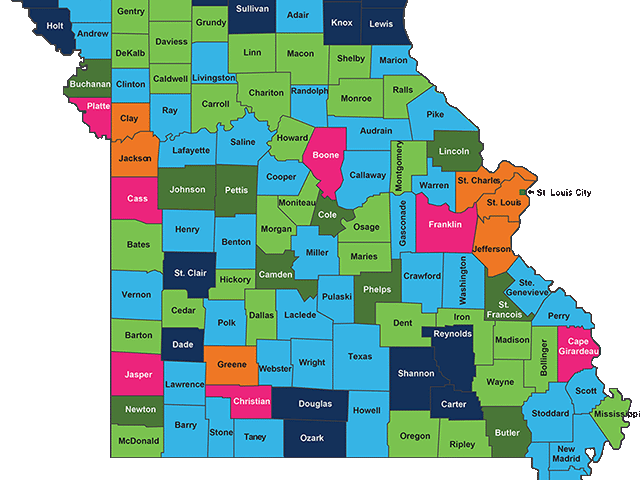

Benefits by County

As of December 31, 2024, approximately 113,000 individuals received benefits from PSRS/PEERS. Total annual benefits paid was over $3.9 billion. Of this amount, over $3.4 billion, or 88%, was distributed among Missouri’s 114 counties, positively impacting the state’s economy.

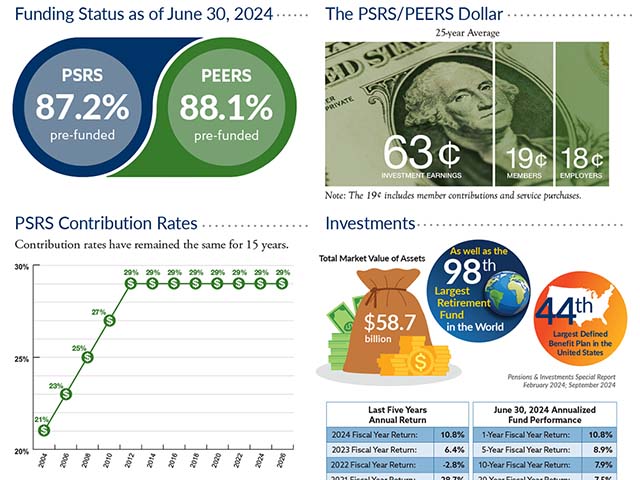

PSRS/PEERS Quick Facts

A summary of PSRS/PEERS statistics as of June 30, 2024.

PSRS/PEERS Funding

PSRS/PEERS' funding comes from three sources, member contributions, employer contributions and investment earnings. Investment earnings are the primary source of funding for every dollar of PSRS/PEERS benefits paid.