Member Tools

These tools and more are available in Web Member Services, the PSRS/PEERS online, self-service membership information portal. Click the links below if you already have a Web Member Services account or register to activate your account.

Tools for Active Members

- View Member Statements

- Estimate Service Retirement Benefits

- Calculate a Purchase Cost

- File for Service Retirement Online

- Designate or Update Beneficiaries

Tools for Retirees and Beneficiaries

Retirement Education

We want to help you learn more about your benefits and retirement system. Our counselors are here to help you get all the information you need, and offer a variety of educational opportunities to best fit your busy life.

Meet the Team » View PSRS Education Options » View PEERS Education Options »PSRS/PEERS News

PSRS/PEERS Fiscal Year 2012-2013 Investment Returns Exceed Goal, Add Over $3.6 Billion in Assets

The Public School and Education Employee Retirement Systems of Missouri's (PSRS/PEERS) strong investment program, coupled with strong overall returns in the global stock market, resulted in the achievement of a 12.6% investment return for the fiscal year ended June 30, 2013.

This return is well above the 8% investment return goal set by the Systems. The PSRS/PEERS market value of invested assets increased through investment earnings by over $3.6 billion from the previous year.

The total plan returns exceeded both the long-term investment goal (actuarially assumed return) of earning 8%, and the total plan policy benchmark* return of 11.2%. Over long periods of time, PSRS/PEERS also continues to produce investment returns that meet or exceed the Systems' objectives. The annualized investment return for the Systems over the last 30 years is 9.3%.

| PSRS/PEERS Investment Return | 12.6% |

|---|---|

| Return Goal | 8% |

| Benchmark Return | 11.2% |

For the year, the PSRS/PEERS internal investment staff and external investment managers added almost $380 million in value above the policy benchmark, net of all fees and expenses.

"Our goal is to provide solid retirement benefits to our members," says Steve Yoakum, PSRS/PEERS executive director. "Our internal investment staff continues to skillfully navigate volatile markets and produce competitive returns at a lower level of risk than most large public pension plans throughout the country. This year, we added significant value above our benchmarks, which helps maintain consistent contribution rates for all of our members and school districts."

PSRS/PEERS maintains a diversified asset allocation of stocks, bonds, real estate, hedged assets and private equity.

| U.S. Stocks | 23.0% |

|---|---|

| Global Stocks | 15.9% |

| Private Equity | 14.8% |

| Real Estate | 12.1% |

| Hedged Assets | 8.5% |

| Treasury Bonds | -1.8% |

The market value of invested assets for PSRS/PEERS was approximately $33.5 billion on June 30, 2013, making the joint entity larger than all other public retirement plans in Missouri combined, and the 45th largest defined benefit plan in the United States. For the most recent PSRS/PEERS investment news, visit us on the web at www.psrs-peers.org.

*The plan policy benchmark is the rate of return achieved by a group of stocks and bonds with overall performance used by investors like PSRS/PEERS as a standard to measure investment performance.

PSRS/PEERS Fiscal Year 2012-2013 Investment Returns Exceed Goal, Add Over $3.6 Billion in Assets

The Public School and Education Employee Retirement Systems of Missouri's (PSRS/PEERS) strong investment program, coupled with strong overall returns in the global stock market, resulted in the achievement of a 12.6% investment return for the fiscal year ended June 30, 2013.

This return is well above the 8% investment return goal set by the Systems. The PSRS/PEERS market value of invested assets increased through investment earnings by over $3.6 billion from the previous year.

The total plan returns exceeded both the long-term investment goal (actuarially assumed return) of earning 8%, and the total plan policy benchmark* return of 11.2%. Over long periods of time, PSRS/PEERS also continues to produce investment returns that meet or exceed the Systems' objectives. The annualized investment return for the Systems over the last 30 years is 9.3%.

| PSRS/PEERS Investment Return | 12.6% |

|---|---|

| Return Goal | 8% |

| Benchmark Return | 11.2% |

For the year, the PSRS/PEERS internal investment staff and external investment managers added almost $380 million in value above the policy benchmark, net of all fees and expenses.

"Our goal is to provide solid retirement benefits to our members," says Steve Yoakum, PSRS/PEERS executive director. "Our internal investment staff continues to skillfully navigate volatile markets and produce competitive returns at a lower level of risk than most large public pension plans throughout the country. This year, we added significant value above our benchmarks, which helps maintain consistent contribution rates for all of our members and school districts."

PSRS/PEERS maintains a diversified asset allocation of stocks, bonds, real estate, hedged assets and private equity.

| U.S. Stocks | 23.0% |

|---|---|

| Global Stocks | 15.9% |

| Private Equity | 14.8% |

| Real Estate | 12.1% |

| Hedged Assets | 8.5% |

| Treasury Bonds | -1.8% |

The market value of invested assets for PSRS/PEERS was approximately $33.5 billion on June 30, 2013, making the joint entity larger than all other public retirement plans in Missouri combined, and the 45th largest defined benefit plan in the United States. For the most recent PSRS/PEERS investment news, visit us on the web at www.psrs-peers.org.

*The plan policy benchmark is the rate of return achieved by a group of stocks and bonds with overall performance used by investors like PSRS/PEERS as a standard to measure investment performance.

Tune in to stay informed about your retirement system, gain valuable insights, and hear from experts on how to make the most of your benefits. Join us for engaging discussions and essential updates designed with your needs in mind.

Life Events

When life brings changes your way, it can also impact your PSRS/PEERS membership. Click below for more information.

A New Member

Welcome! Your membership gives you distinct advantages when working toward a financially secure retirement. Get off to the right start and register for access to Web Member Services today.

Newly Married

If you are recently married, it can impact your beneficiary designations.

A New Parent

Birth or adoption of a child requires you to update your beneficiary designations.

Recently Divorced

If you named your spouse as a beneficiary, divorce means you may need to update your beneficiary designations. Some divorced retirees may also have options for benefit increases, or "pop-ups."

Moving

Keep your contact information up-to-date so we can communicate with you about your membership and ensure benefits are paid according to your wishes.

Ready to Retire

Apply for service retirement online using Web Member Services, or using paper forms found on this website.

Leaving Your Job

You have options when temporarily or permanently leaving covered employment.

A Working Retiree

It is important to understand post-retirement work limits and how they may impact your benefit payments.

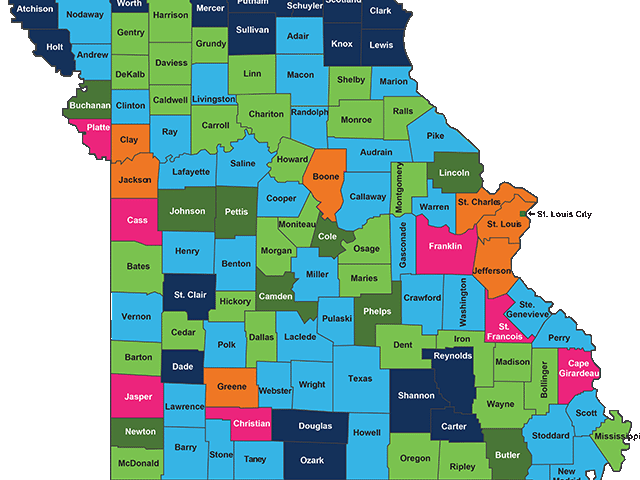

Benefits by County

As of June 30, 2025, approximately 113,000 individuals received benefits from PSRS/PEERS. Total annual benefits paid was nearly $4.0 billion. Of this amount, over $3.5 billion, or 88%, was distributed among Missouri's 114 counties, positively impacting the state's economy.

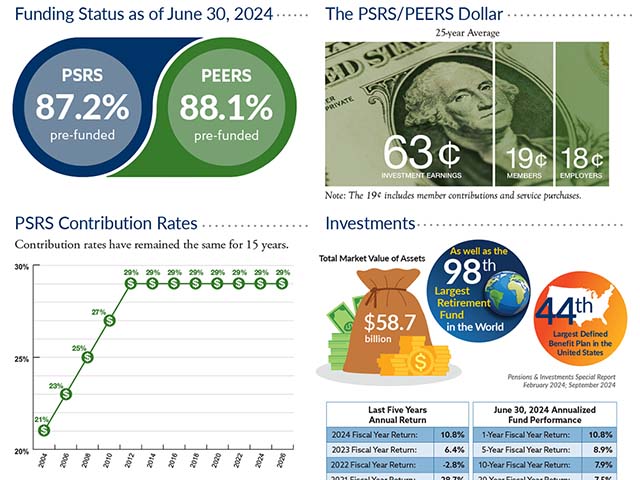

PSRS/PEERS Quick Facts

A summary of PSRS/PEERS statistics as of June 30, 2025.

PSRS/PEERS Funding

PSRS/PEERS' funding comes from three sources, member contributions, employer contributions and investment earnings. Investment earnings are the primary source of funding for every dollar of PSRS/PEERS benefits paid.