Member Tools

These tools and more are available in Web Member Services, the PSRS/PEERS online, self-service membership information portal. Click the links below if you already have a Web Member Services account or register to activate your account.

Tools for Active Members

- View Member Statements

- Estimate Service Retirement Benefits

- Calculate a Purchase Cost

- File for Service Retirement Online

- Designate or Update Beneficiaries

Tools for Retirees and Beneficiaries

Retirement Education

We want to help you learn more about your benefits and retirement system. Our counselors are here to help you get all the information you need, and offer a variety of educational opportunities to best fit your busy life.

Meet the Team » View PSRS Education Options » View PEERS Education Options »PSRS/PEERS News

Sick Leave/Workers' Comp and Military Purchase Deadline is June 30

With the school year half over, it is important to consider whether you are eligible to purchase service for your unpaid sick leave, workers' compensation leave or military leave.

Unpaid Sick Leave and Workers’ Compensation Leave

You may purchase retirement service that you lost because of unpaid sick leave or workers’ compensation leave as long as payment for the service is completed within two school years following the leave. This means if your leave occurred during the 2010-2011 school year, your deadline to complete the purchase is June 30, 2013. Unpaid sick leave may include time you were on maternity or paternity leave.

Your cost is the contributions you would have made to PSRS/PEERS during the full period of the leave. Contact your employer to determine if your leave is eligible and arrange your payment to purchase service for this leave. Tax-deferred (rollover) funds can be used to pay for this type of service purchase.

Military Leave

PSRS/PEERS members who have been on military leave covered by the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) may purchase up to five years of service.

To qualify, you must return to employment after your military leave with the same employer and apply to purchase the leave within five years of re-employment. Your cost is based on the salary rate that you would have been paid and the contribution rate in effect during your leave. You pay the employee portion and your employer pays the employer portion.

Your USERRA-covered service counts toward PSRS/PEERS vesting and retirement eligibility, regardless of whether you purchase your service. Purchased service is also included in the total service used to calculate your retirement benefit. For more information on purchasing service, please contact us at (800) 392-6848.

Sick Leave/Workers' Comp and Military Purchase Deadline is June 30

With the school year half over, it is important to consider whether you are eligible to purchase service for your unpaid sick leave, workers' compensation leave or military leave.

Unpaid Sick Leave and Workers’ Compensation Leave

You may purchase retirement service that you lost because of unpaid sick leave or workers’ compensation leave as long as payment for the service is completed within two school years following the leave. This means if your leave occurred during the 2010-2011 school year, your deadline to complete the purchase is June 30, 2013. Unpaid sick leave may include time you were on maternity or paternity leave.

Your cost is the contributions you would have made to PSRS/PEERS during the full period of the leave. Contact your employer to determine if your leave is eligible and arrange your payment to purchase service for this leave. Tax-deferred (rollover) funds can be used to pay for this type of service purchase.

Military Leave

PSRS/PEERS members who have been on military leave covered by the federal Uniformed Services Employment and Reemployment Rights Act (USERRA) may purchase up to five years of service.

To qualify, you must return to employment after your military leave with the same employer and apply to purchase the leave within five years of re-employment. Your cost is based on the salary rate that you would have been paid and the contribution rate in effect during your leave. You pay the employee portion and your employer pays the employer portion.

Your USERRA-covered service counts toward PSRS/PEERS vesting and retirement eligibility, regardless of whether you purchase your service. Purchased service is also included in the total service used to calculate your retirement benefit. For more information on purchasing service, please contact us at (800) 392-6848.

Tune in to stay informed about your retirement system, gain valuable insights, and hear from experts on how to make the most of your benefits. Join us for engaging discussions and essential updates designed with your needs in mind.

Life Events

When life brings changes your way, it can also impact your PSRS/PEERS membership. Click below for more information.

A New Member

Welcome! Your membership gives you distinct advantages when working toward a financially secure retirement. Get off to the right start and register for access to Web Member Services today.

Newly Married

If you are recently married, it can impact your beneficiary designations.

A New Parent

Birth or adoption of a child requires you to update your beneficiary designations.

Recently Divorced

If you named your spouse as a beneficiary, divorce means you may need to update your beneficiary designations. Some divorced retirees may also have options for benefit increases, or "pop-ups."

Moving

Keep your contact information up-to-date so we can communicate with you about your membership and ensure benefits are paid according to your wishes.

Ready to Retire

Apply for service retirement online using Web Member Services, or using paper forms found on this website.

Leaving Your Job

You have options when temporarily or permanently leaving covered employment.

A Working Retiree

It is important to understand post-retirement work limits and how they may impact your benefit payments.

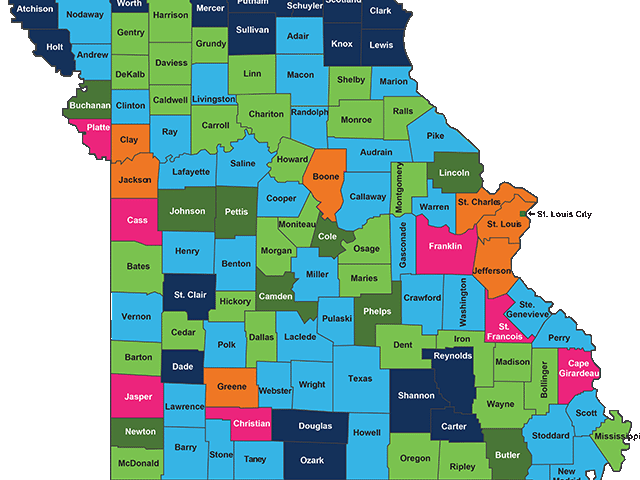

Benefits by County

As of June 30, 2025, approximately 113,000 individuals received benefits from PSRS/PEERS. Total annual benefits paid was nearly $4.0 billion. Of this amount, over $3.5 billion, or 88%, was distributed among Missouri's 114 counties, positively impacting the state's economy.

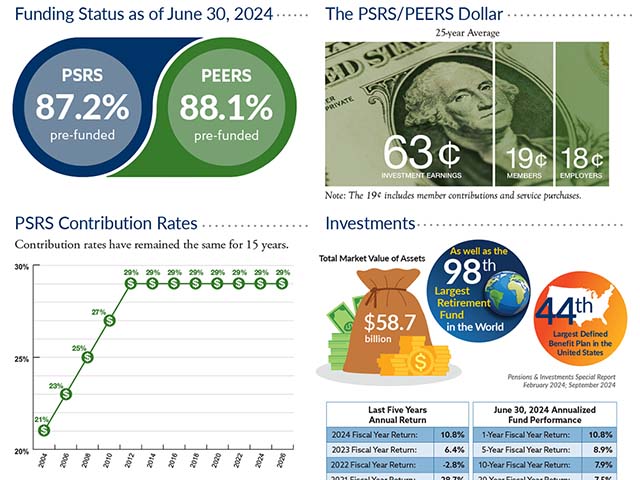

PSRS/PEERS Quick Facts

A summary of PSRS/PEERS statistics as of June 30, 2025.

PSRS/PEERS Funding

PSRS/PEERS' funding comes from three sources, member contributions, employer contributions and investment earnings. Investment earnings are the primary source of funding for every dollar of PSRS/PEERS benefits paid.