June 2022 Board of Trustees Meeting Summary

The Public School and Education Employee Retirement Systems of Missouri (PSRS/PEERS) Board of Trustees convened on June 5 and June 6, 2022. In attendance were Board members Jason Steliga, Dr. Kyle Collins, Sharon Kissinger, Dr. Melinda Moss and Dr. Eric Park. Also present were Executive Director Dearld Snider; Assistant Executive Director, Operations Bill Betts; Assistant Executive Director, Investments Craig Husting; General Counsel Sarah Swoboda; Chief Financial Officer Anita Brand; Chief Technology Officer Lisa Scheulen; Director of Human Resources Kim Harris; Director of Member Services Nicole Hamler; Director of Employer Services Stacie Verslues; Director of Communications Susan Wood; Director of Internal Audit, Jeff Hyman; Director of Executive and Board Administration Jennifer Martin; and various other PSRS/PEERS staff members.

Sunday, June 5, 2022

Investments

Public Credit and Real Estate Program Review

Mr. Frank Aten and Ms. Jessica Wilbers from PSRS/PEERS reviewed the Systems’ Public Credit portfolio including program objectives, guidelines and long-term results. The five-year annualized return for the Public Credit composite for the period ended April 30, 2022 was 2.3%. Ms. Susan Conrad and Ms. Chhayhea Sam from PSRS/PEERS reviewed the Systems’ Real Estate portfolio including program objectives, guidelines and long-term results. The five-year annualized return for the Real Estate composite for the period ended March 31, 2022 was 11.0%.

Budget and Audit Committee

Minutes

The Budget and Audit Committee session minutes from the April 10, 2022 meeting were approved by unanimous vote.

Annual Banking Resolution

Ms. Anita Brand from PSRS/PEERS reviewed a memo regarding a banking resolution. The resolution provides continuing authority to Mr. Dearld Snider, Mr. Bill Betts and Mr. Craig Husting to make necessary changes related to the Systems’ banking relationship with Central Bank. The banking resolution authorizes appropriate individuals to execute documents with the bank without additional approval by the Board of Trustees. The resolution automatically expires each June 30 or when a new resolution is received by Central Bank. The Budget and Audit Committee approved the resolution by unanimous vote.

Strategic Plan Presentation and Strategic Plan Policy

Mr. Bill Betts from PSRS/PEERS reviewed with the Board the 2023-2025 Strategic Plan and the four focus areas: System and Financial Stability, Culture of Excellence, Engagement and Innovation. Mr. Betts shared a snapshot of the key initiatives developed by the management team. The key initiatives are developed through a formal process to help support the strategic plan. Each initiative listed is unique to the 2022-2023 fiscal year and does not include annual events, regular processes or routine projects such as Member Statements, the Annual Comprehensive Financial Report, legislative monitoring, IRS Forms 1099-R etc. Based on these objectives, Ms. Anita Brand was able to incorporate the projects into the 2022-2023 budget.

After a review of the Systems’ Strategic Plan, Mr. Betts reviewed the Strategic Plan Policy. Mr. Betts shared the PSRS/PEERS management team’s recommendation to change the term “tactics” to “key initiatives” within the Strategic Plan Policy. The team feels key initiatives is more representative of the items captured and presented to the Board. Once the updated policy is approved, it will be included in the Board’s Governance Policies. These policies are reviewed annually to ensure they are living documents serving to guide the functions of the Board, while also evolving to meet the changing needs of the Board and the Systems over time.

Discussion and Approval of the Fiscal Year 2022-2023 Budget

Ms. Brand reviewed the fiscal year 2022-2023 proposed budget request. Ms. Brand provided information regarding the processes utilized to develop the budget. The budget was compiled based on the Systems' mission of providing retirement security to Missouri's educators and public school employees in the most efficient and cost-effective manner possible. Ms. Brand provided the following budget highlights and provided detailed discussion on significant changes from the prior year.

The total request has increased by 7.1% from the fiscal year 2021-2022 adjusted budget. The overall increase is driven by an expected 7.4% increase in benefit payments to members.

The investment expenses are comprised of investment fees and investment administrative expenses. Budgeted investment fees increased compared to the prior year. The increase is directly related to the assets under management and current contracts with investment managers. Investment fees are paid and budgeted in accordance with current legal contracts. The Systems account for and budget all investment fees including performance and incentive fees. Actual expenses will be directly dependent on the market environment.

The budget request also includes an increase in investment administrative expenses. The increase is attributed to the addition of two investment positions and the completion of a comprehensive compensation study in accordance with the Board of Trustees' Compensation Strategy. Investment returns are reported net of investment fees and investment administrative expenses.

The total administrative budget is made up of the capital asset budget (items over $10,000 that are capitalized) and the administrative budget. The fiscal year 2022-2023 budget request for capital assets is inclusive of the final close out of the building expansion and renovation project. The project is considered complete, and the facility is being utilized by staff, members, employers and Trustees. The remaining anticipated expenses are to close out retainage balances and final orders of signage and other direct owner costs. The project was completed substantially under budget.

Administrative expenses have increased from the previous year. The increase is attributed to the addition of five full-time positions and the completion of a comprehensive compensation study in accordance with the Board of Trustees' Compensation Strategy. Throughout the proposed budget request, the Systems have decreased the budget where appropriate. However, the overall proposed budget request has increased in order to meet the Systems' long-term goals and strategic objectives. The Systems’ administrative expenses are funded through investment earnings.

The Budget and Audit Committee approved the budget as presented by staff by unanimous vote.

Internal Audit Report

Mr. Jeff Hyman from PSRS/PEERS presented the internal audit annual report to the committee. The internal audit department completed nine audit engagements and performed consulting services in various areas in accordance with, and in addition to, the fiscal year 2021-2022 PSRS/PEERS audit plan. Mr. Hyman also reviewed the internal audit plan for fiscal year 2022-2023.

Regular Board Meeting

System Operations

Minutes

The open session minutes from the April 10 and April 11, 2022 meetings were approved by unanimous vote.

Order of Business

None

LEAD Group Recognition

Graduates of the first LEAD (Leadership Exploration and Development) group were recognized and presented with a certificate. The purpose of the program is to identify, develop and retain internal talent for leadership positions to sustain our culture and support the ongoing growth of our organization. Members recognized were Amber Ewing, Human Resources; Ciara Bauer, Information Technology; Chhayhea Sam, Investments; Dellanta Butler, Employer Services; Jenny Patterson, Information Technology; Paula Balmer, Member Services; Lori Schenewerk, Member Services; Randy Angerer, Information Technology; Sheri Morgan, Member Services; Steve Drews, Investments; Stephanie Rankin, Member Services; and Tracy Weber, Accounting.

Investment Report

Investment Performance Report (March 31, 2021)

Mr. Craig Husting from PSRS/PEERS and Mr. Michael Hall from Russell reviewed the investment performance for the period ended March 31, 2022. The one-year PSRS/PEERS investment return was reported as 12.4%, while the fiscal year return (July 1, 2021 through March 31, 2022) was reported as 4.2%.

Ongoing Investment Activity

Mr. Husting and Mr. Hall reviewed ongoing investment activities, which included estimated investment performance through May 31, 2022. The estimated fiscal year investment return (July 1, 2021 through May 31, 2022) was reported as approximately 1.0%. Mr. Husting discussed the investment markets, rebalancing activity in April and May and the current PSRS/PEERS asset allocation.

Management Report

Board Meeting Dates for Fiscal Year 2023

The fiscal year 2022-2023 Board of Trustees meeting dates were reviewed and approved by unanimous vote. The following dates were set for fiscal year 2022-2023 meetings: August 29, 2022; October 24, 2022; December 5, 2022; February 6, 2023; April 17, 2023, and June 11-12, 2023.

Annual Banking Resolution

Ms. Brand reviewed a memo regarding a banking resolution, which was unanimously approved earlier in the day by the Budget and Audit Committee. The resolution provides continuing authority to Mr. Dearld Snider, Mr. Bill Betts and Mr. Craig Husting to make necessary changes related to our banking relationship with Central Bank. The Board approved the resolution by unanimous vote.

Fiscal Year 2022-2023 Budget Approval

The proposed fiscal year 2022-2023 budget, as presented to the Budget and Audit Committee, was approved by the Board by unanimous vote.

Strategic Plan Presentation and Strategic Plan Policy

The proposed 2023-2025 Strategic Plan, as presented to the Budget and Audit Committee, was approved by the Board by unanimous vote.

The proposed changes to the Strategic Plan Policy, as presented to the Budget and Audit Committee, were approved by the Board by unanimous vote.

Plan Policy-Compensation Proration Under Internal Revenue Code section 401(a)(17)

Ms. Brand reviewed a memo regarding the annual compensation limit for tax-qualified plans under Internal Revenue Code section 401(a)(17). Ms. Brand recommended the adoption of policies that would prorate earnings based on service awarded. The Board approved the policies by unanimous vote.

Legislative Update

Mr. Mike Moorefield from PSRS/PEERS and Mr. Jim Moody, legislative consultant, updated the Board on the 2022 Missouri legislative session. Mr. Moody updated the Board on state general revenue collection through May 2022. Mr. Moorefield reviewed the 2022 legislative statistics, along with upcoming important dates remaining for the General Assembly in 2022. Additionally, he reviewed SB 681, legislation that directly impacts the Systems, along with other bills that would have impacted the Systems but did not pass.

SB 681 (Conference Committee Substitute #2/House Committee Substitute/Senate Substitute/Senate Committee Substitute Senate Bills 681 & 662) contains the substitute teacher working after retirement waiver language. This language waives the working after retirement limits on part-time or temporary-substitute work performed by PSRS/PEERS retirees as substitute teachers for covered employers or third-party providers. The waiver would apply from the date the bill is signed into law – due to an emergency clause that applies to waiver provision – until June 30, 2025.

The Systems are implementing processes and preparing regulations if the governor signs SB 681 into law. The governor has until July 14 to act upon all legislation.

Finally, Mr. Moorefield touched on other legislative issues of interest to the Systems.

Working After Retirement Proposed Regulations

Ms. Sarah Swoboda from PSRS/PEERS presented to the Board proposed regulation amendments that involve working after retirement. The proposed regulation amendments are related to the passage of Conference Committee Substitute #2/House Committee Substitute/Senate Substitute/Senate Committee Substitute Senate Bills 681 & 662), otherwise referred to as SB 681, an omnibus education bill, which contains a temporary waiver (through June 2025) of working after retirement limits for PSRS and PEERS retirees who return to work to substitute teach. The proposed amendments will be filed if Governor Parson signs SB 681.

To administer this new law as it relates to PSRS/PEERS retirees, PSRS/PEERS must define what it means to substitute teach. The updated regulation defines teach to mean, “to instruct or guide the studies of students in a teaching position which requires a DESE-issued certificate.” This definition will exclude both non-certificated positions (such as bus drivers, custodial staff) and certificated positions which are not “teaching” positions (such as superintendents, administrators, etc.). While substitute teaching is rare in a community college context, a definition was included that may qualify a long-term substitute under the waiver. For community colleges, to teach shall mean, “to instruct or guide the studies of students in a teaching position certified by the executive officer of the college pursuant to Section 169.140, RSMo.” (This excludes supervisory and administrative positions.)

For purposes of the temporary working after retirement limit waiver, the proposed amended regulations provide that substitute teaching means that the retiree is serving in place of a regularly employed teacher who is temporarily unavailable. A regularly employed teacher is temporarily unavailable when that teacher’s position is unfilled due to the absence of the regular or former teacher for one year (12 months) or less. This will not cover situations when a retiree continually fills a position on a part-time basis (e.g., teaches one or two classes every year), or when a school district is continually unable to fill an open position after the regular teacher leaves (for more than one year). Those situations will require that any retiree’s work is subject to limits (550 hours and 50% of salary) or be certified as Critical Shortage Employment. The Board of Trustees approved the proposed regulation by unanimous vote.

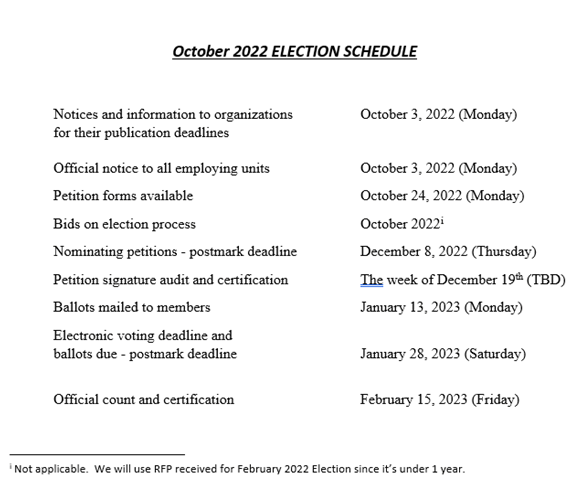

2023 Special Board of Trustees Election Schedule Approval

A special Board of Trustees election will be held to fill a seat that will be vacant due to Dr. Melinda Moss’ upcoming retirement and departure from the Board. The Board approved the following special Board of Trustees election schedule:

Ms. Jennifer Martin from PSRS/PEERS explained there is not a specific date on the schedule for the petition signature and audit certification step due to this being the week before Christmas. PSRS/PEERS will reach out to Missouri educational associations to see what date will work for the majority of them, since representatives of those associations audit and certify the petitions.

CPI-U Update

Mr. Dearld Snider from PSRS/PEERS reviewed the COLA policy that was set by the Board at their November 3, 2017 meeting. According to the policy, COLAs may be granted based on the Consumer Price Index for Urban Consumers (CPI-U) as follows:

| CPI-U | COLA per Board-Approved Funding Policy |

|---|---|

| Less than 0.0% | 0.0% |

| 0.0%-2.0% | 0.0% when CPI-U is cumulatively below 2.0% |

| 0.0%-2.0% | 2.0% when CPI-U cumulatively reaches 2.0% or more* |

| 2.0%-5.0% | 2.0% when the CPI-U is at least 2.0%, but less than 5.0% |

| 5.0% or more | 5.0% |

| *resets cumulative calculation after a COLA is provided | |

Mr. Snider explained that the CPI-U is calculated by the Bureau of Labor Statistics (BLS). The CPI-U is the measure of the change in prices of goods and services purchased by urban consumers between any two time periods. PSRS/PEERS’ regulations require that the time period for the CPI-U calculation used in the determination of a COLA be from June to June. Based on the values provided by the BLS, the CPI-U is up 6.4090% through April 30, 2022.

| Index Values | |||

|---|---|---|---|

| June 2021 | 271.696 | Month | To-Date |

| July 2021 | 273.003 | 0.0082 | 0.4811% |

| August 2021 | 273.567 | 0.0021 | 0.6886% |

| September 2021 | 274.310 | 0.0027 | 0.9621% |

| October 2021 | 276.589 | 0.0083 | 1.8009% |

| November 2021 | 277.948 | 0.0049 | 2.3011% |

| December 2021 | 278.802 | 0.0031 | 2.6154% |

| January 2022 | 281.148 | 0.0084 | 3.4789% |

| February 2022 | 283.716 | 0.0091 | 4.4241% |

| March 2022 | 287.504 | 0.0134 | 5.8183% |

| April 2022 | 289.109 | 0.0056 | 6.4090% |

The May reading for the CPI-U will not be released until June 10, 2022.

Closed Session

The Board went into closed session at 11:55 a.m.

Adjournment

The Board adjourned at 1:48 p.m.

This summary is not official minutes of the PSRS/PEERS Board of Trustees meeting. The official minutes will be approved at the next PSRS/PEERS Board of Trustees meeting and will posted to our website at that time.